City Manager Sends Message to FL DOGE Ahead of Gainesville Audit

On Wednesday, Gainesville City Manager Cynthia Curry sent the following message to the Florida Department of Governmental Efficiency (DOGE) and Chief Financial Officer Blaise Ingoglia, city email records show.

Introduction

The City of Gainesville welcomes the opportunity to cooperate fully with the Florida Department of Government Efficiency (DOGE) in its review of municipal finances and operations. This response, assembled by the City Manager's Office in coordination with department leaders, includes documentation and narrative context addressing each area of inquiry.

Gainesville is a unique city-home to a flagship university, a vibrant and civically engaged population, and a government that has taken bold steps in recent years to improve financial sustainability, enhance transparency and realign services with community needs. Since 2021, City of Gainesville leaders have made difficult but necessary decisions to right size operations, consolidate functions and strengthen accountability. These reforms reflect the steady and focused work of municipal departments that continue to deliver core services—particularly in public safety, infrastructure and neighborhood support —with care and competence.

City leaders and staff appreciate the opportunity to present the requested data and share the organization's commitment to sound fiscal management and responsible governance.

Financial Oversight and JLAC Compliance

Gainesville has participated in state-level audits since 2019, involving the Florida Auditor General and the Joint Legislative Auditing Committee (JLAC). That review identified several areas for improvement, including a recommendation that the City reduce its reliance on transfers from Gainesville Regional Utilities to the General Fund.

During an appearance by City of Gainesville officials before JLAC on February 23, 2023, City leaders were urged to make significant structural changes—described at the time by JLAC members as bold actions — to reduce GRU's debt burden.

The guidance from JLAC members included:

• You will have to make tough decisions.

• Today there's been talk of raising the millage to come out of that hole.

• Get rid of positions that haven't been filled. Get rid of some resources you haven't used.

• What is your current millage rate and when is the last time it was raised?

In direct response to that guidance:

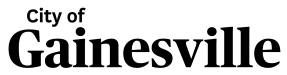

- The City, while GRU reported to the City Commission, developed a new transfer formula that reduced the amount to $15.3 million, a reduction of more than 55% from the previous level of $34.3 million.

- At that time, the transfer was the second largest revenue source for the City.

- The annual transfer from GRU to the City has continued to decline under the GRU Authority Board, shrinking to a projected $7.1 million in FY 2026.

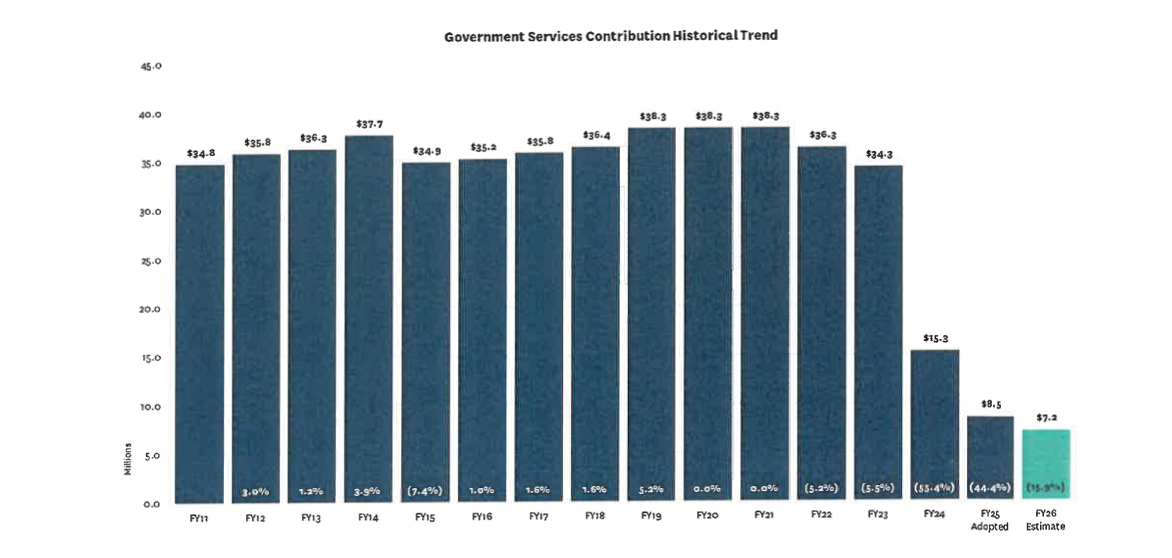

- The City passed a millage rate increase in FY 2024, raising the rate by 0.9297 mills, resulting in a rate of 6.4297 mills. That represented a 16.9% increase compared to the previous year's rate of 5.5000 mills. This was projected to generate an estimated additional $15.4 million in property tax revenue.

- The millage rate did not increase in FY 2025.

- On July 17, the City Commission set a Maximum/Not-To-Exceed Millage Rate for FY 2026 of 6.8912 mills. It is 0.4615 mills or 7.2% higher than the current rate; this is not adoption of a new level but setting a cap beyond which commissioners cannot legally adopt any higher rate at final budget hearings upcoming in fall of 2025.

- These decisions were made through open public processes and reflect the City's ongoing efforts to remain aligned with the vision, mission and goals of the City with a focus on protecting core services and maintaining financial stability.

Budget Growth and Revenue Trends

Ad Valorem Revenue and Property Tax Increases

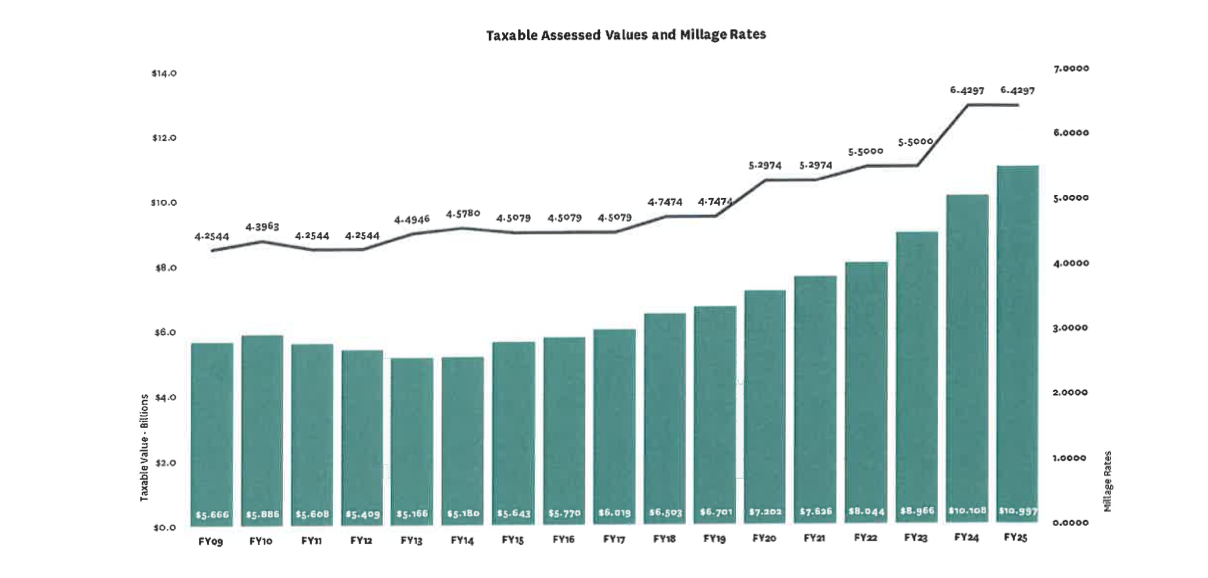

As noted by the Governor in his announcement of the DOGE audit, the City has received over the past five years increased ad valorem revenue.

Since FY 2020:

- The City's taxable value has grown by $3.8 billion or 52.7%.

- Of this growth, $1.1 billion was due to new construction, representing 29.7% of the taxable value growth.

- The City's millage rate has increased by 21.4%.

This includes a City Commission vote to increase the millage rate by 16.9% in FY 2024. This was directly driven by the 55.4% reduction in the City's second largest revenue source, the General Fund Transfer from GRU. - The ad valorem revenue has increased by 85.8%, driven primarily by a combination of rising property values and new construction. In addition, a component of the tax revenue increase is due to millage rate increases.

Note that 2025 property tax collections are still underway and this represents collections through June 30, 2025.

Annual Budget Growth

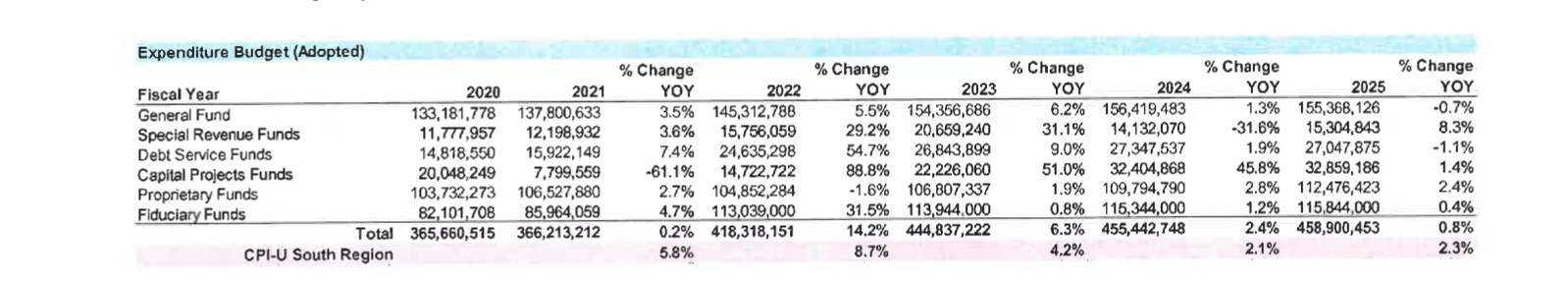

From FY 2020 through FY 2025, the City's All Funds Budget has grown by $93.2 million or 25.5%. The All Funds Budget has grown slightly less than the compounded CPI growth for that same time period of 25.2%. The All Funds Budget has grown on average $18.6 million or 4.6% annually. In addition to the City's General Fund, the All Funds Budget includes budget appropriations for Special Revenue Funds (revenue for specific uses and grants), Debt Service Funds (obligations determined by borrowing agreements), Capital Projects Fund (funding for various capital projects), Proprietary Funds (funding for transportation), and Fiduciary Funds (funding for pension plans). The City's General Fund makes up only 33.9% of the All Funds budget in FY 2025. The majority of budget fluctuations have occurred outside of the General Fund and have been primarily driven by new grant funding received by the City (American Rescue Plan Act), and Alachua County Half-cent Infrastructure Surtax for Wild Spaces Public Places and Infrastructure projects.

From FY 2020 through FY 2025, the City's General Fund Budget has grown by $22.2 million or 16.7%. The General Fund Budget has grown 851 basis points less than the compounded CPI growth for that same time period of 25.2%. The General Fund Budget has grown on average $4.4 million or 3.1% annually. When compared to the annual CPI for each of the last five years, the General Fund Budget has grown by less than the CPI in four out of the five years.

These changes reflect cost increases in areas such as personnel-including pension obligations, health care and inflationary adjustments- -alongside necessary investments in core services, particularly public safety.

Public Safety and Infrastructure as Budget Priorities

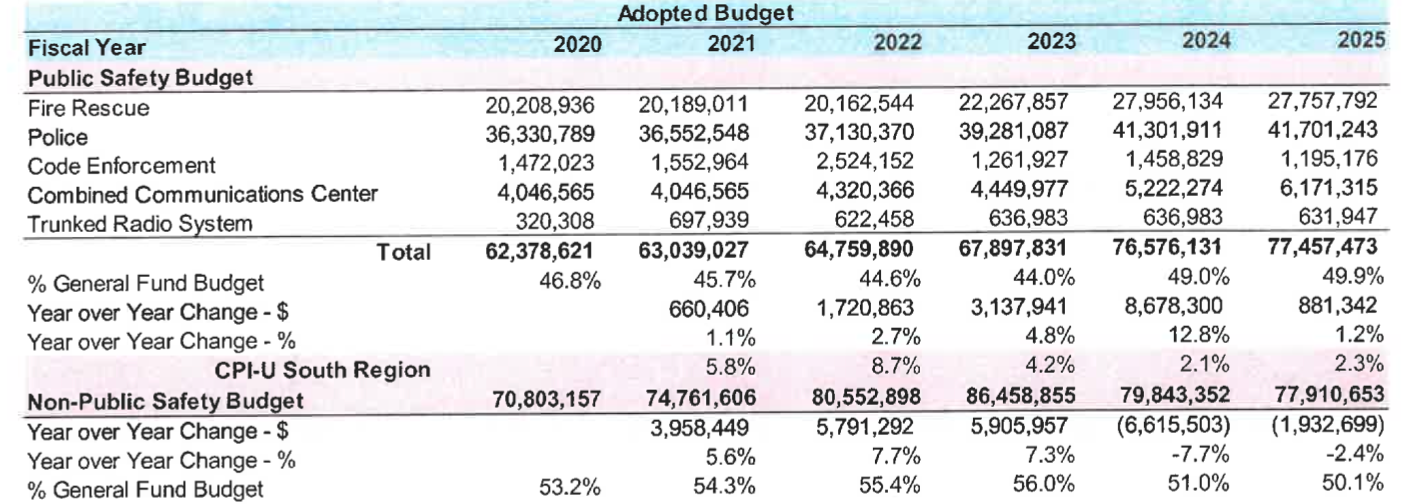

The following table provides an overview of General Fund expenditures from FY 2020 - FY 2024.

The largest single category of General Fund spending in Gainesville is public safety, which includes the Gainesville Police Department (GPD), Gainesville Fire Rescue (GFR), Code Enforcement, the Combined Communications Center and the Trunked Radio System. From FY 2020 through FY 2025, the City's Public Safety Budget has grown by $15.1 million or 24.2%. This represents 68.0% of the General Fund growth ($22.2 million) over the same time period. In FY 2025, these expenditures represent 49.9% of the total General Fund Budget. From FY 2020 through FY 2025, the City's Non-Public Safety Budget has grown by $7.1 million or 10.0%. This represents 32.0% of the General Fund growth ($22.2 million) over the same time period. In FY 2025, these expenditures represent 50.1% of the total General Fund Budget. Furthermore, since FY 2024, due to the reduce revenue resulting from the Government Services Contribution reductions, the Non-Public Safety Budgets have been reduced by $8.5 million.

The primary cost drivers for public safety costs are negotiated compensation and overtime. The funding also has supported wage adjustments established through union-negotiated contracts, including competitive raises for Gainesville police officers and the launch of a 24/72-hour shift schedule for firefighters- for the City to remain competitive in recruitment and operational efficiency.

In addition, outside of the General Fund, the City is expanding public safety intrastructure with an estimated $30 million Southwest Public Safety Center, a $22 million new GPD Property and Evidence building, and a new $15 million Fire Station #3. Funding support comes from the Streets, Stations, and Strong Foundations (SSSF) initiative, made possible by the Alachua County voter-approved Half-cent Infrastructure Surtax for critical projects such as road repairs, fire stations, affordable housing and stormwater improvements.

In efforts to reduce pressure on the General Fund, the City has leveraged American Rescue Plan Act (ARPA) and other funding to launch a community-based engagement strategy called IMPACT GNV as part of the effort to support public safety initiatives, specifically addressing gun violence. In addition, the City Commission allocated 2% of Gainesville's ARPA funds - almost $650,000 - to address gun violence through support of youth health and wellbeing through the National League of Cities' One Nation One Project (ONOP) initiative.

Fiscal Reforms and External Audits

Gainesville continues taking action to strengthen its financial position, reduce expenditures and increase transparency.

Since FY 2024, the City has made the following adjustments:

- 161.5 staff positions eliminated across City departments across two fiscal years totaling $10.9 million.

- The City Manager took the leadership in salary reductions by voluntarily reducing her salary by 5%.

- Independent audits completed annually, with no findings in FY 2023 and FY 2024.

For the second year in a row, the City of Gainesville has received a clean financial audit from external auditor Purvis, Gray & Company. The City's Department of Financial Services completed the Fiscal Year 2024 Annual Comprehensive Financial Report (ACFR) on schedule with no findings. These results are confirmation the City is managing its finances with a high level of accuracy, transparency and accountability.

- Implemented the Management Watch program to provide focused support to areas needing improvement.

- Credit rating upgraded by Fitch Ratings in 2024, citing material expenditure reductions and strong financial resilience.

- Ongoing compliance with financial reporting and performance standards at the state and national level.

These improvements reflect the City's sustained effort to right size operations, eliminate inefficiencies and streamline service delivery. Departments across Gainesville have embraced a culture of accountability, innovation, and continuous improvement.

FY 26 Budget Development

The City continues to develop the FY 2026 budget. Staff is preparing a budget proposal for the City Commission to consider at the First Public Hearing scheduled for September 10, 2025 and the Second Public Hearing scheduled for September 24, 2025.

Transparency and Cooperation

To date, Gainesville has received three formal information requests from DOGE:

- March 18, 2025: EOG DOGE Efforts & Inquiry Regarding Financial Condition Under Section 218.503, Florida Statutes - request completed

- July 11, 2025: Florida DOGE - request for information - request completed.

- July 21, 2025: EOG OPB, DOGE, and CFO Request - efforts to provide information underway.

The City Manager's Office is coordinating the response to the July 21 request. City departments are working to provide the requested documentation, ensure data system access, and make appropriate subject matter experts available to the DOGE team.

Conclusion

The City of Gainesville remains fully committed to transparency, public accountability and collaborative engagement in all aspects of municipal governance.